Keeping accurate financial records is vital for any business, and reconciliation in QuickBooks plays a key role in this process. Reconciliation ensures that your QuickBooks balances align with your bank or credit card statements, giving you a clear view of your financial health.

If you’re wondering how to reconcile in QuickBooks online or how to reconcile QuickBooks desktop, this comprehensive guide will walk you through both processes.

We will explain what reconciliation is, why it matters, and provide detailed step-by-step instructions to help you reconcile your accounts in both QuickBooks Online and Desktop versions. You’ll also learn best practices for efficient and error-free reconciliation, ensuring your financial records stay up-to-date and accurate.

What is QuickBooks reconciliation and why does it matter for your business?

Reconciliation in QuickBooks is the process of matching your company’s financial records with your bank or credit card statements to ensure accuracy. It involves reviewing transactions, ensuring all entries are correct, and identifying any discrepancies between your internal records and external financial statements.

Reconciliation helps verify that all expenses and income have been properly recorded, and it ensures the balance in QuickBooks matches the actual account balance, helping maintain accurate financial reporting.

Why reconciliation matters for your business?

- Accuracy: Ensures your financial records reflect reality

- Error detection: Catches duplicate entries, missing transactions, or data entry mistakes

- Fraud prevention: Identifies unauthorized transactions quickly

- Cash flow management: Provides accurate picture of available funds

- Tax compliance: Maintains clean records for accurate tax reporting

- Business decisions: Reliable data for informed financial decisions

While reconciliation is important for all businesses, wholesale companies, distributors, and manufacturers face unique complexities that make manual reconciliation particularly challenging:

- High transaction volumes: Processing hundreds of B2B orders monthly

- Multiple sales channels: Orders from sales reps, trade shows, and online portals

- Complex pricing: Customer-specific pricing, volume discounts, and payment terms

- Inventory complications: Real-time stock updates across multiple warehouses

These complexities mean that what might take a small business 30 minutes monthly can consume hours for B2B companies, unless you have the right systems in place.

Now that we’ve got the basics down, let’s dive into the practical steps of reconciling your accounts in QuickBooks Online.

How to reconcile in QuickBooks online?

Learning how to reconcile in QuickBooks online is straightforward when you follow the right steps. This how to reconcile in QuickBooks tutorial will guide you through each phase of the online reconciliation process.

1. Prepare for reconciliation in QuickBooks online

Gather your statements: Before you begin, ensure you have your bank or credit card statements handy. You’ll need the starting and ending balances, along with details about transactions such as deposits, withdrawals, fees, and interest.

Verify data entry: Double-check that all transactions, such as expenses, income, and payments, are entered correctly in QuickBooks Online.

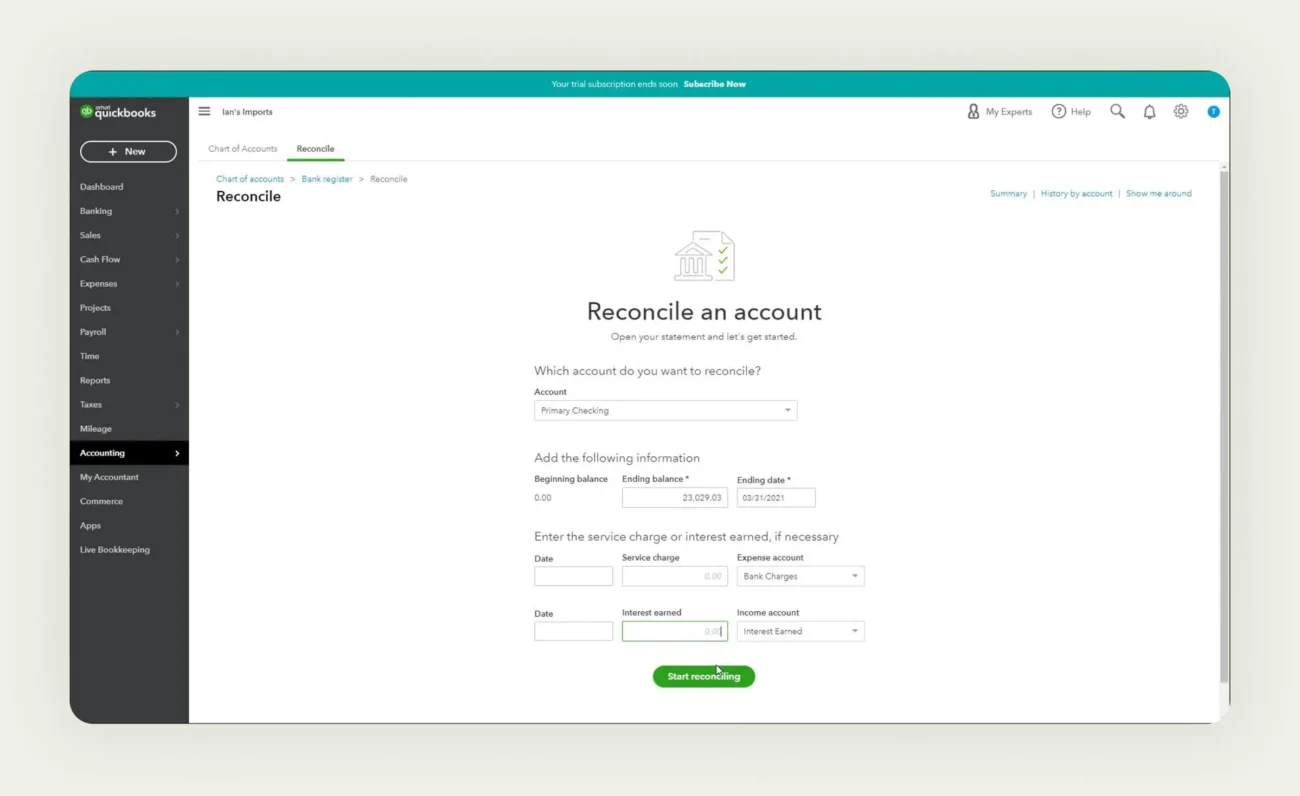

2. Navigate to the reconciliation page

This is the next crucial step when learning how to reconcile in QuickBooks online.

- Log in to your QuickBooks Online account

- From the Dashboard, click on the Accounting menu on the left-hand side

- Select Reconcile under the Accounting tab

3. Select your account to reconcile

In the Reconciliation page, use the drop-down menu to select the Bank or Credit Card account you want to reconcile.

4. Enter statement information accurately

Statement ending balance: Enter the ending balance exactly as it appears on your bank or credit card statement. Precision here is key to successfully reconcile QuickBooks online accounts.

Ending date: Input the ending date from the statement you are reconciling.

Beginning balance: QuickBooks will automatically display the beginning balance. This should match the beginning balance on your bank statement. If it doesn’t, it could indicate issues with previous reconciliations.

Service charges or interest earned: If there are any bank fees, service charges, or interest payments noted on your statement, enter those in the appropriate fields. Make sure the dates and amounts are correct.

5. Match transactions in QuickBooks online

You’ll now see a list of transactions in QuickBooks that match your statement period.

Match deposits and payments:

- Cross-check each transaction in QuickBooks with your bank statement

- Check the box next to the transaction if it matches

- If any transactions don’t match or are missing, investigate further to see if they were entered incorrectly or missed in QuickBooks

6. Add or edit missing transactions

If you notice any missing or incorrect transactions, you can add or edit them directly in QuickBooks.

- Click on the + New button to add any missing deposits, payments, or expenses

- You can also edit incorrect transactions from the reconciliation window by clicking on the specific transaction and making changes

7. Check for discrepancies

The Difference box in QuickBooks should show “$0.00” once all transactions are matched. This means your QuickBooks balance matches the bank statement balance.

If the difference is not zero, it indicates that there are discrepancies. You may need to:

- Look for duplicate transactions

- Double-check the beginning balance and ending balance

- Ensure that all deposits and withdrawals are accurately recorded

8. Finish your QuickBooks online reconciliation

Once the Difference is zero, click Finish Now to complete the reconciliation.

If you’re not ready to reconcile yet, you can click Save for Later and return to it when you’re ready.

9. Review reconciliation reports

After completing the reconciliation, you can view a Reconciliation Report that details the transactions matched and the ending balance.

To access the report:

- Go to the Reports section from the left menu

- Search for “Reconciliation Reports” to review your finished reconciliations

This report can help track reconciliation history and resolve any future discrepancies.

10. Handle reconciliation discrepancies

If you notice discrepancies during reconciliation that you can’t resolve, QuickBooks provides a Reconciliation Discrepancy Report to help you identify any adjustments or changes made to previously reconciled transactions.

To view this report:

- Go to Reports, type “Reconciliation Discrepancy,” and run the report to analyze any adjustments

Now that you’ve mastered the QuickBooks Online reconciliation process, let’s explore how the process differs in QuickBooks Desktop, which many businesses still use for their accounting needs.

How to reconcile QuickBooks desktop?

If you’re using the desktop version, how to reconcile QuickBooks desktop follows a similar but slightly different process. Learning how to reconcile in QuickBooks desktop gives you more detailed control over your reconciliation. This how to reconcile in QuickBooks desktop guide covers all the essential steps.

1. Access reconciliation in QuickBooks desktop

Before starting, create a backup of your company file and ensure all transactions for the statement period have been entered into QuickBooks.

To begin reconciliation:

- Click Banking in the main menu

- Select Reconcile from the dropdown

- Choose the account you want to reconcile

Note: For merchant accounts, QuickBooks may prompt you to sign in to verify your connection.

2. Select account and enter statement details

QuickBooks automatically populates your starting balance and suggests a statement date based on your previous reconciliation. You’ll need to enter key details from your bank statement:

| Field | What to enter | Important notes |

| Ending balance | Final balance from your statement | Must match exactly – even penny differences cause issues |

| Service charges | Any bank fees shown | Only include fees not already recorded in QuickBooks |

| Interest earned | Interest credited to your account | Enter the date and appropriate income account |

If your opening balance doesn’t match your statement, click Locate Discrepancies to run diagnostic reports or Undo Last Reconciliation to start over (this will reset all previously cleared transactions).

3. Review and match desktop transactions

The reconciliation window organizes transactions into clear sections – bank accounts separate debits and credits, while credit card accounts show charges versus payments. QuickBooks offers helpful features like filtering transactions by statement period and sorting by different criteria.

Work systematically through each transaction on your bank statement. Find the corresponding entry in QuickBooks, verify the date, amount, and reference number match, then click the checkmark to mark it as cleared.

Key indicators while matching:

- Cleared balance decreases with cleared checks, increases with cleared deposits

- Items marked cleared” section shows your progress totals

- Many bank statements provide similar summaries for verification

4. Resolve discrepancies in desktop version

Discrepancies are common and usually resolvable through careful review. Missing transactions need to be entered before reconciliation, while transactions in QuickBooks that don’t appear on your statement shouldn’t be marked as cleared (likely timing differences).

You can examine transaction details by selecting any item and clicking “Go To,” or modify your reconciliation settings if you discover errors in service charges, interest, or ending balance. When reconciling multiple months, always work chronologically from oldest to newest.

5. Complete desktop reconciliation process

Your reconciliation is complete when the difference equals exactly $0.00. Click Reconcile Now to permanently mark all selected transactions as cleared.

QuickBooks offers immediate reporting options – you can display the reconciliation report on screen or print a copy for your records. The system automatically saves your reconciliation and maintains permanent records accessible through Reports → Reports Center.

Reconciled transactions will show checkmarks in your account registers, providing visual confirmation that your QuickBooks records now accurately reflect your actual account balances.

Using outdated QuickBooks? Read our blog post to see what you can do!

While both QuickBooks Online and Desktop offer comprehensive reconciliation capabilities, understanding their differences can help you choose the right version for your business needs and reconciliation workflow.

QuickBooks online vs desktop: Reconciliation differences explained

Understanding how to reconcile in QuickBooks online versus how to reconcile QuickBooks desktop helps you choose the right platform. Both methods allow you to reconcile QuickBooks effectively, but the interface and features differ significantly.

The choice between versions often depends on factors like team size, location flexibility, automation preferences, and technical comfort level. Each platform has distinct advantages that appeal to different types of businesses and users.

| Feature | QuickBooks online | QuickBooks desktop |

| Accessibility | Cloud-based; accessible from any device with an internet connection. | Desktop-based; requires installation on a local system or server. |

| User interface | More simplified and streamlined interface with a step-by-step process. | More feature-rich but slightly more complex interface compared to the online version. |

| Automation | More automation with bank feeds, often auto-matching transactions for reconciliation. | Less automation; transactions are matched manually, but bank feeds can be set up for some automation. |

| Multiple users | Multiple users can work simultaneously in QuickBooks online without being in the same location. | Requires a network or multi-user license for multiple users; often less seamless than QuickBooks online. |

| Adjustments | Adjustments for discrepancies can be made easily through the bank feed feature. | Discrepancies require manual adjustments; may need journal entries for complex adjustments. |

| Historical reconciliations | QuickBooks online saves reconciliation history and allows you to access reports easily. | QuickBooks desktop also keeps reconciliation reports, but accessing them requires more navigation compared to the online version. |

| Report generation | Reconciliation reports can be generated and shared easily through the cloud. | Reports can be printed or saved, but sharing them typically requires export and email. |

| Undo reconciliation | In QuickBooks Online, only accountants can undo reconciliation using QuickBooks online accountant. | QuickBooks desktop allows users to manually undo reconciliations without needing special permissions. |

Which version is right for your business?

Choose QuickBooks Online if you need:

Flexibility and accessibility are your top priorities. The online version excels for modern businesses requiring:

- Remote access: Multiple locations or team members working from different places

- Device flexibility: Access from phones, tablets, or any computer with internet

- Automated workflows: Bank feeds and transaction matching that reduce manual data entry

- Minimal IT maintenance: Automatic updates and cloud backups without technical overhead

- Subscription preference: Lower upfront costs with predictable monthly expenses

QuickBooks Online is particularly suitable for growing businesses, companies without dedicated IT support, or organizations that process high transaction volumes and want to minimize reconciliation time.

Choose QuickBooks desktop if you have:

Complex business requirements that demand advanced functionality. Desktop offers superior capabilities for:

- Advanced reporting: Detailed customization and industry-specific report formats

- Inventory management: Sophisticated tracking for manufacturing or distribution businesses

- Job costing: Project-based accounting with detailed cost allocation

- Industry tools: Specialized features for construction, nonprofit, or professional services

- Local control: On-premise data storage with complete system ownership

Desktop appeals to established businesses with complex workflows, accounting professionals who prefer traditional interfaces, or companies with specific compliance requirements that need extensive customization options.

Regardless of which QuickBooks version you choose, following proven best practices will ensure your reconciliation process is efficient, accurate, and provides reliable financial data for your business decisions.

Best practices to reconcile QuickBooks accounts efficiently

Implementing consistent reconciliation practices protects your business from financial errors, ensures accurate reporting, and saves valuable time during your monthly accounting procedures. These proven strategies work effectively with both QuickBooks Online and Desktop versions.

1. Reconcile monthly for accuracy

Frequency: Reconcile your bank and credit card accounts monthly when you receive your statements.

Stay current: Regular reconciliation ensures that discrepancies are caught early and financial data remains accurate.

2. Verify starting balances before you begin

Ensure the beginning balance in QuickBooks matches the opening balance on your bank or credit card statement. Mismatched starting balances could indicate prior errors or unreconciled transactions.

3. Double-check all transaction details

Carefully review and match all transactions, including deposits, payments, fees, and interest. Ensure no duplicates or missing entries are overlooked during reconciliation.

4. Investigate discrepancies immediately

If the reconciliation difference isn’t zero, don’t proceed until the discrepancy is resolved. Look for transaction errors, incorrect data entry, or duplicate transactions to pinpoint the issue.

5. Enter bank fees and interest accurately

Input any bank fees, service charges, or interest correctly during the reconciliation process to ensure all financial details align with your statement.

6. Use QuickBooks reconciliation reports

After completing a reconciliation, review the Reconciliation Report for accuracy. This report provides a detailed summary of reconciled transactions, which is useful for record-keeping and future reviews.

7. Lock previous reconciliations

Once a reconciliation is complete, avoid making changes to reconciled transactions. If adjustments are necessary, document them clearly and run a reconciliation discrepancy report to keep a record.

8. Reconcile all business accounts

In addition to bank and credit card accounts, reconcile other important accounts such as loans and PayPal accounts, if applicable, to maintain full financial oversight.

9. Maintain clear team communication

If multiple users work in QuickBooks, ensure clear communication to avoid changes to reconciled transactions or errors that could disrupt the reconciliation process.

10. Backup your QuickBooks data regularly

Regularly back up your QuickBooks data to prevent any loss of information and safeguard your financial records before and after reconciliation

By following these best practices, you can ensure accurate and efficient reconciliations in QuickBooks, minimizing errors and keeping your financial records up-to-date.

However, certain errors can still occur even with careful preparation. Knowing how to quickly identify and resolve these common problems will keep your reconciliation process on track.

Common QuickBooks reconciliation errors and solutions

Even experienced users encounter reconciliation challenges. Understanding these common issues and their solutions can save you significant time and frustration during your monthly reconciliation process.

01. Mismatched beginning balances

The problem: Your beginning balance in QuickBooks doesn’t match your bank statement’s opening balance.

This usually happens when the previous month’s reconciliation was incomplete, reconciled transactions were modified after completion, or transactions were entered in the wrong accounting period. These discrepancies create a domino effect that impacts all future reconciliations.

Quick solutions:

- Run a reconciliation discrepancy report to identify changes to previously reconciled transactions

- Verify that the previous month’s reconciliation was properly completed

- Look for unreconciled transactions from prior periods that should have been included

02. Missing or duplicate transactions

The problem: Transactions appear on your bank statement but not in QuickBooks, or the same transaction appears multiple times.

This commonly occurs when bank feeds create duplicate entries alongside manual entries, transactions are entered in wrong accounts or periods, or there are simple data entry oversights. The issue becomes more complex when checks or electronic payments are recorded but haven’t yet cleared your bank.

Quick solutions:

- Search for missing transactions in other accounts or different date ranges

- Review bank feed settings to prevent automatic duplicate creation

- Check for timing differences where transactions were recorded in different periods

03. Incorrect bank fee recording

The problem: Bank fees, service charges, or interest aren’t properly recorded or are recorded incorrectly during reconciliation.

Many users accidentally enter fees twice (once manually and once during reconciliation) or assign them to incorrect accounts. Interest is sometimes mistakenly recorded as an expense rather than income, which throws off both reconciliation and financial reporting.

Quick solutions:

- Always check for existing fee transactions before entering them during reconciliation

- Assign service charges to appropriate expense accounts and interest to income accounts

- Set up memorized transactions for recurring monthly fees to ensure consistency

04. Timing differences in transaction dates

The problem: Transactions are recorded on different dates in QuickBooks versus when they actually cleared your bank.

This is particularly common with checks that recipients haven’t deposited yet, electronic payments that process on different dates than recorded, or deposits made after bank cutoff times. Understanding the difference between transaction dates and cleared dates is crucial for successful reconciliation.

Quick solutions:

- Focus on cleared dates rather than transaction dates during reconciliation

- Keep a running list of outstanding checks and deposits in transit

- Don’t force-reconcile transactions that haven’t actually cleared your bank yet

Maintain consistent transaction entry procedures, review bank feeds regularly for accuracy, and consider performing weekly mini-reconciliations to catch errors before they accumulate into larger problems.

While these manual reconciliation challenges are manageable with the right knowledge, many B2B businesses are discovering that automation can eliminate these issues entirely and transform their entire financial workflow.

Eliminate QuickBooks reconciliation headaches with WizCommerce’s seamless integration

Manual reconciliation becomes time-consuming when sales data, inventory, and accounting live in separate systems. WizCommerce integrates directly with both QuickBooks Online and Desktop, automatically syncing customer information, orders, inventory levels, and payments in real-time. This eliminates the manual data entry and transaction hunting that typically causes reconciliation discrepancies.

With WizCommerce’s QuickBooks integration:

- Automated data sync: Every B2B transaction flows automatically from your sales process to QuickBooks with consistent data mapping. No more hunting for missing transactions or investigating discrepancies.

- Real-time integration: Customer data, order details, and payment information sync instantly, eliminating the timing differences that cause reconciliation headaches.

- Error prevention: Automated workflows prevent duplicate entries, missing transactions, and data inconsistencies that typically complicate monthly reconciliation.

- Multi-channel management: Whether orders come from sales reps, trade shows, or your B2B ecommerce site, everything syncs seamlessly with QuickBooks.

Instead of spending hours matching transactions and investigating missing entries, your reconciliation process becomes a quick verification that typically takes minutes rather than hours.

Ready to automate your QuickBooks reconciliation? Book a demo to see how WizCommerce eliminates manual reconciliation headaches for B2B businesses.

Frequently asked questions about QuickBooks reconciliation

How to un-reconcile in QuickBooks online?

To un-reconcile in QuickBooks online, you need QuickBooks Online Accountant access or admin privileges. Go to Settings > Reconcile, select your account, then choose “History by account.” Find the reconciliation to undo and click “View report,” then select “Undo.” This reverses all transactions from that reconciliation period, requiring you to reconcile QuickBooks again after making corrections.

How to get reconciliation details in QuickBooks online?

Access reconciliation details by navigating to Settings > Reconcile, selecting your account, and clicking “History by account.” This displays all past reconciliations with dates and balances. Click “View report” for detailed transaction lists showing cleared items. You can also find reconciliation reports under Reports > Standard > Reconciliation Reports to track your how to reconcile in QuickBooks online history.

How do you re-reconcile in QuickBooks online?

To re-reconcile after corrections, start a new reconciliation for the same period using identical statement information. Go to Settings > Reconcile, enter your statement details, and mark transactions as cleared again. Ensure any adjustments made since the previous reconciliation are reflected before you reconcile QuickBooks. The process follows the same how to reconcile in QuickBooks online steps as your original reconciliation.

What is the difference between QuickBooks online accountant and QuickBooks online?

QuickBooks Online Accountant is free for accounting professionals managing multiple clients, while QuickBooks Online is the paid business version. Accountant access includes exclusive features like undoing reconciliations and advanced client management tools. Business owners use regular QuickBooks Online and can invite accountants with special permissions to help reconcile QuickBooks and manage their books.

Does QuickBooks online automatically reconcile?

No, QuickBooks Online doesn’t automatically reconcile accounts. While bank feeds can import and suggest transaction matches, you must manually review and mark transactions as cleared. The bank feeds feature makes it easier to reconcile QuickBooks online by auto-categorizing recurring transactions, but completing the full how to reconcile in QuickBooks online process requires manual verification to ensure accuracy.